Property owner retention, also known as investor retention, is fundamental to the financial success of any property management company. Why? Studies show that when an investor stays longer, your wallet thickens. For perspective, increasing an investor’s lifetime value (LTV) from 3 years to 5 years can boost profits by up to $840,000 annually. And according to a 2024 survey, 41% of property management companies plan to focus on property owner retention because it’s evident that it significantly impacts business outcomes.

Enhancing property owner retention hinges on several factors, with property maintenance standing out as a controllable aspect that can be optimized to elevate the resident experience and increase owner retention.

Rent retention and investor retention go hand in hand..Resident retention involves property managers or landlords implementing various tactics, like exceptional customer service, property upkeep, lease renewal incentives, and fostering community, to encourage existing residents to extend their leases and stay longer. The ultimate goal of rent retention is to ensure a stable and consistent revenue stream or the property owner by minimizing turnover and vacancy rates.

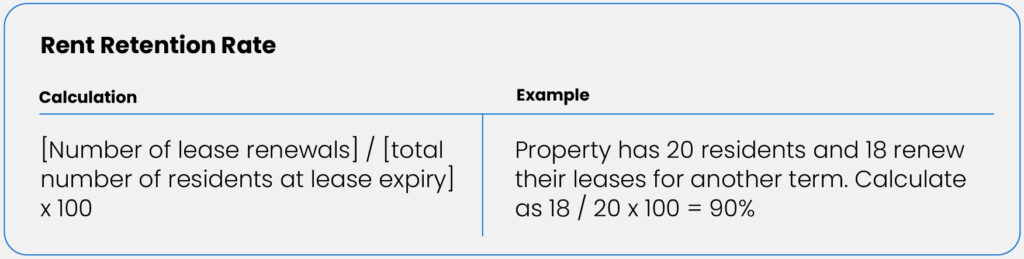

What is Rent Retention?

Rent retention is a critical concept in property management that refers to the ability of a landlord or property owner to retain residents over a specific period. It’s a vital metric because it directly influences the stability and profitability of rental properties. Landlords who can retain residents consistently not only reduce vacancy rates but also save on leasing costs and maintain a steady income stream.

Rent retention is often measured as a percentage and represents the number of residents who choose to renew their leases at the end of their initial lease term. For instance, if a property has 20 residents, and 18 of them decide to renew their leases for another term, the rent retention rate would be calculated as:

Right now, aiming for above 50% of rent retention is considered healthy, with world-class operators shooting for 70% retention.

What Is a Property Manager’s First Responsibility to the Owner?

A property manager’s primary responsibility to the owner is to protect and maximize the value of the owner’s investment property.. Ultimately, the property manager acts as the owner’s representative, overseeing all aspects of the property’s operations to achieve the owner’s goals and objectives.

One of the best ways to take care of your investors’ property is to retain reliable residentskeep renting them to the same people. By keeping excellent renters who pay promptly and maintain the property well, you reduce costs for your investors.

First of all, you know the property is being well maintained and secondly, you aren’t wasting money to turn the unit over, get it marketed to new residents, and aren’t losing rent as the unit sits vacant. The more lease renewals you have, the less money you are spending on turnovers. Less turnover means more money in your pocket and the pocket of your investors.

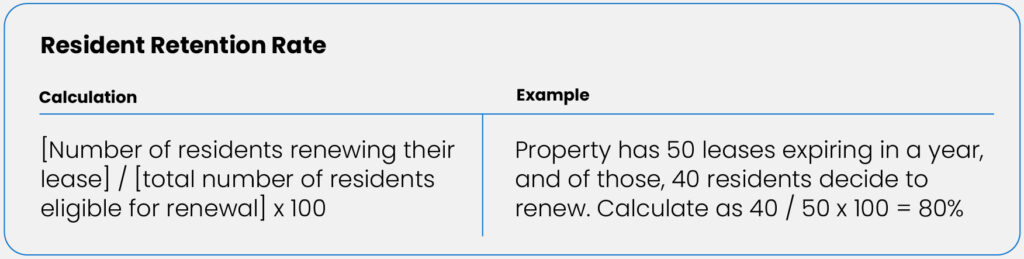

How to Calculate Resident Retention

Calculating resident retention involves understanding how many residents choose to renew their leases compared to the total number of residents whose leases are up for renewal within a specific period, typically annually. The formula for resident retention rate is:

[resident retention rate] = [number of residents renewing their lease] / [total number of residents eligible for renewal] x 100

For example, if a property had 50 leases expiring in a year and 40 residents decided to renew their leases, the resident retention rate would be 40/50 x 100 = 80%

Importance of Rent Retention

High rent retention rates indicate high resident satisfaction, which is essential for maintaining a positive reputation in property management. It can also translate into reduced turnover costs associated with advertising, showing, and preparing a unit for new residents. Plus, long-term residents often contribute to a sense of community within a property, which can lead to higher overall resident satisfaction and lower turnover rates.

Ultimately, rent retention is a key performance indicator in property management that reflects resident satisfaction, operational efficiency, and overall financial performance. By understanding and actively managing rent retention rates, landlords and property managers can enhance the long-term success and profitability of their rental properties.

How Do You Retain Good Residents?

Retaining good residents lands as a key priority for landlords and property managers according to 2024 property management research. It contributes to stability, reduces turnover costs, and fosters a positive rental experience for all parties involved. Having effective resident retention strategies in place is crucial for maintaining a high occupancy rate and ensuring a steady profit. Here are some proven resident retention strategies to help you retain your best residents:

- Provide Excellent Customer Service: Consistent, excellent customer service can significantly impact resident satisfaction and loyalty. By responding promptly to maintenance requests, addressing concerns or issues, and maintaining open lines of communication shows them that their well-being is a priority.

- Keep the Property Pristine: A well-maintained property enhances the living experience for residents and encourages them to stay longer. Conducting regular inspections and investing in upgrades or improvements when necessary creates an attractive environment that residents are proud to call home.

- Offer Lease Renewal Incentives: By providing incentives to residents who renew their leases, such as discounted rent, upgraded amenities, or extended lease terms, demonstrates appreciation for their loyalty and encourages them to commit to another lease term.

- Build a Sense of Community: By organizing social events, creating communal spaces, or implementing a resident referral program allows connections between residents. This fosters a supportive and inclusive environment, making them more likely to renew their leases.

- Communicate Effectively: Keep residents informed about important updates, policies, or changes within the property by being transparent and approachable while encouraging residents to voice their feedback or concerns.

- Encourage Feedback & Take Action: Listen to resident feedback and address any concerns or issues promptly and professionally. Taking proactive steps to resolve problems demonstrates that you value residents’ input and are committed to providing a high-quality living experience.

- Conduct Regular Check-Ins: Schedule regular check-ins with residents to assess their satisfaction, address any issues, and discuss their future plans. Use these opportunities to build rapport, gather feedback, and identify areas for improvement.

- Offer Flexible Lease Terms: Consider offering flexible lease terms, such as month-to-month or short-term leases, to accommodate residents’ changing needs or circumstances. Providing flexibility can attract and retain residents who prefer more flexibility in their living arrangements.

Prioritizing resident satisfaction and communication fosters a sense of loyalty and ensures the continued success of rental properties.

How to Measure Resident Satisfaction

Measuring resident satisfaction is paramount for any organization involved in property management because it allows you to determine what may be causing your residents to leave for another property.

- Define key metrics: Start by identifying the essential metrics that contribute to resident satisfaction. These could include factors such as speed of repair, technician utilization rate, your vendor health score, and how much preventative maintenance you are doing.

- Surveys and feedback: Implement regular surveys and feedback mechanisms to gather insights directly from residents with a range of topics. These can take the form of online surveys, suggestion boxes, or face-to-face interviews.

- Social media monitoring: Monitor social media platforms for mentions, reviews, and comments about your property or community. This can provide valuable real-time feedback and identify areas for improvement based on resident experiences and sentiments shared online.

- Benchmarking: Compare your resident satisfaction metrics against industry benchmarks or similar properties/communities to gain context and identify areas where you may be falling behind or excelling.

- Employee feedback: Solicit feedback from employees who interact directly with residents, such as property managers, maintenance staff, and front desk personnel. They often have valuable insights into resident preferences, concerns, and satisfaction levels based on their day-to-day interactions.

- Continuous improvement: Use the feedback gathered to implement targeted improvements and initiatives aimed at enhancing resident satisfaction. Regularly revisit and reassess your measurement methods to ensure they remain relevant and effective over time.

- Long-Term Tracking: Establish a system for long-term tracking of resident satisfaction metrics to identify trends and patterns over time. This allows you to track the impact of interventions and measure progress towards overarching satisfaction goals.

Property managers can gain valuable insights into resident needs, preferences, and concerns by adopting a multifaceted approach to measuring resident satisfaction, incorporating both quantitative and qualitative methods. This, in turn, enables them to make informed decisions and implement targeted strategies to enhance the overall resident experience and foster a thriving, happy community.

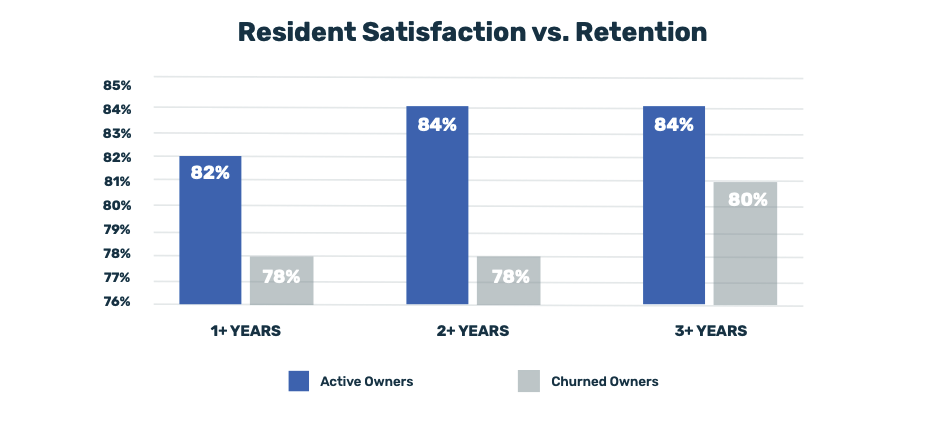

The Connection Between Resident Satisfaction and Investor Retention

The satisfaction of residents plays a pivotal role in fostering a positive living environment and driving investor retention and business success. While it may seem intuitive that happy residents lead to higher retention rates, the depth of this connection and its impact on investor satisfaction are often underestimated. Let’s explore why prioritizing resident satisfaction is essential for maintaining investor loyalty and maximizing returns.

- Stable revenue streams: Satisfied residents are more likely to renew their leases and stay in a property for the long term. This stability in occupancy rates translates into consistent rental income for investors, reducing vacancy risks and ensuring a steady cash flow. Property managers can minimize turnover costs and maximize revenue generation by prioritizing resident satisfaction, thereby enhancing investor returns.

- Enhanced property value: A well-maintained property with happy residents tends to retain its value better over time. Positive word-of-mouth referrals from satisfied renters can attract new residents and contribute to a strong reputation within the market. Investors benefit from this increased property value, as it enhances the attractiveness of the asset and may lead to higher resale values or rental rates in the future.

- Reduced costs: High resident turnover can incur significant costs associated with advertising, leasing, and unit turnover. By focusing on resident satisfaction and reducing turnover rates, property managers can minimize these operational expenses, thereby improving the overall financial performance of the property.

- Mitigated risks: Investor satisfaction is closely linked to the mitigation of risk factors associated with property ownership. Satisfied residents are less likely to file complaints, pursue legal action, or engage in behaviors that could negatively impact the property’s reputation or operational stability. By proactively addressing resident concerns and maintaining high satisfaction levels, property managers can help investors mitigate potential risks and safeguard their investments.

- Long-term partnerships: Investors seek stable, long-term partnerships with property management companies that demonstrate a track record of success and a commitment to maximizing returns. By prioritizing resident satisfaction as a core business objective, property managers can strengthen their relationships with investors and foster trust and loyalty over time. This, in turn, can lead to repeat investments, referrals, and additional business opportunities within the investor network.

In summary, the connection between resident satisfaction and investor retention is undeniable. Happy residents contribute to stable revenue streams, enhanced property values, reduced operational costs, mitigated risk factors, and long-term partnerships—all of which are essential components of a successful real estate investment strategy.

By recognizing the link between resident satisfaction and investor satisfaction, property managers can align their efforts to deliver exceptional resident experiences while driving value for investors.

How Maintenance Data Fuels Investor Retention

Effective property maintenance is not just about fixing things when they break—it’s a strategic investment that directly impacts investor retention and long-term profitability. By harnessing maintenance data, property managers can gain valuable insights into the health of their properties, make informed decisions, and ultimately enhance investor satisfaction. Let’s explore how leveraging maintenance data can fuel investor retention and drive business success.

- Predictive Maintenance Strategies: Maintenance data allows property managers to identify trends and patterns in equipment failure, wear and tear, and repair frequency. By analyzing this data, managers can implement predictive maintenance strategies, proactively addressing issues before they escalate into costly repairs or disruptions.

- Cost Optimization: Tracking maintenance data provides visibility into accurate property management costs, including labor, materials, and contractor expenses. By analyzing this data, property managers can identify opportunities for cost optimization, such as negotiating better vendor contracts, optimizing maintenance schedules, or investing in energy-efficient solutions.

- Enhanced Reporting and Transparency: Maintenance data enables property managers to generate detailed reports and insights for investors, providing transparency into property performance and maintenance activities. By sharing relevant data and metrics, like speed of repair, maintenance cost per unit, and resident satisfaction scores, managers can demonstrate their commitment to operational excellence, risk management, and value creation. This transparency fosters trust and confidence among investors, reinforcing their commitment to long-term partnerships with the property management team.

- Compliance and Risk Mitigation: Maintenance data plays a crucial role in ensuring compliance with regulatory requirements and mitigating potential risks associated with property ownership. By maintaining accurate records of maintenance activities, inspections, and repairs, managers can demonstrate compliance with relevant laws, codes, and industry standards.

- Continuous Improvement: Maintenance data serves as a feedback mechanism for continuous improvement and optimization of property management processes. By analyzing historical maintenance data and performance metrics, managers can identify areas for improvement, implement corrective actions, and refine their maintenance strategies over time. This iterative approach drives operational efficiency, enhances asset performance, and ultimately delivers value for investors.

By monitoring these specific KPIs in maintenance, property management companies will be equipped with a powerful asset that fuels investor retention. By enabling property managers to make data-driven decisions, optimize costs, track asset performance, enhance transparency, mitigate risks, and drive continuous improvement, they can demonstrate their commitment to maximizing returns, protecting asset value, and fostering long-term partnerships with investors.

Leading and Lagging Indicators of Property Owner Retention

In the competitive landscape of property management, retaining property owners is paramount for sustained success and growth. Understanding leading and lagging indicators can empower property managers to anticipate challenges, implement effective strategies, and foster long-term relationships with property owners. Let’s delve into what these indicators entail and how they contribute to the retention of property owners.

Leading Indicators: Proactive Measures for Future Retention

- Communication Frequency and Quality: Regular, transparent communication serves as a leading indicator of property owner retention. Proactively updating owners on property performance, market trends, and maintenance issues not only fosters trust but also demonstrates a commitment to their investment.

- Resident Satisfaction: Monitoring resident satisfaction through surveys or feedback channels offers insights into the overall health of a property. High resident satisfaction often correlates with satisfied property owners, indicating effective management practices and potential for long-term retention.

- Speed of Repairs: Prompt resolution of maintenance issues is crucial for preserving property value and resident satisfaction. Leading indicators include response times to maintenance requests, adherence to maintenance schedules, and proactive upkeep to prevent costly repairs.

- Market Analysis and forecasting: Staying abreast of market trends and forecasting future property performance showcases proactive management skills. Property owners appreciate managers who can anticipate challenges and capitalize on opportunities, ultimately enhancing their investment returns.

Lagging Indicators: Reflective Measures of Past Performance

- Owner retention rate: The percentage of property owners who renew their contracts or continue partnerships over a specific period serves as a fundamental lagging indicator. A declining retention rate may signal dissatisfaction or inefficiencies in management practices.

- Financial performance metrics: Lagging indicators such as rental income growth, occupancy rates, and profitability provide retrospective insights into property performance. Monitoring these metrics over time helps identify trends and gauge the effectiveness of management strategies.

- Owner feedback and reviews: Soliciting feedback and reviews from property owners offers valuable insights into their satisfaction levels and areas for improvement. Positive reviews often correlate with high retention rates, while negative feedback can prompt corrective actions to mitigate future issues.

- Days on Market: The duration of property vacancies serves as a lagging indicator of management effectiveness. Prolonged vacancies may indicate pricing inefficiencies, marketing challenges, or resident retention issues that impact owner profitability.

In conclusion, a holistic approach to property owner retention encompasses both leading and lagging indicators. By proactively addressing challenges, delivering exceptional service, and leveraging data-driven insights, property managers can cultivate strong relationships with owners and foster long-term loyalty. Embracing a proactive mindset and continuously refining management practices are key to achieving sustained success in the dynamic property management industry.